A new report from the Hobby School of Public Affairs shows many Houston-area households are experiencing growing financial insecurity, widespread debt and limited savings. (Credit Getty Images)

Key Takeaways

- Over 70% of SPACE City Panel respondents said their household has debt, with the most common being credit cards (52.1%), car loans (36.1%) and other debt such as a mortgage (29.4%).

- Fewer than one-third (29.5%) of respondents said their household income would “probably” or “definitely” keep pace with inflation over the next year.

- Among the respondents who are sure their income won’t keep up, 38.1% said they were considering moving from Houston and 37.9% said they were open to the possibility.

Many Houston-area households are experiencing growing financial insecurity driven largely by inflation and widespread debt, according to a new report from the University of Houston’s Hobby School of Public Affairs.

The findings — released as part of the Center for Public Policy’s Survey on Public Attitudes and Community Engagement City Panel, or SPACE City Panel — follow recent U.S. Census Bureau data showing the city of Houston has the highest poverty rate among major U.S. cities at 21.2%.

While census data paints a broad picture of financial strain, CPP researchers can fill the gap with quarterly, in-depth household-level surveys.

“We want to understand what’s happening at the household level, which is something publicly available data doesn’t necessarily reflect,” said Pablo Pinto, director of the CPP and professor in the Hobby School.

With nearly 86% of respondents identifying the high cost of living as a top economic challenge, 46% of households reported cutting back spending on essential needs, like food and energy, and more than half of households cut back on discretionary items such as vacation, recreation and vehicles.

“We want to understand what’s happening at the household level, which is something publicly available data doesn’t necessarily reflect.”

— Pablo Pinto, UH’s Center for Public Policy

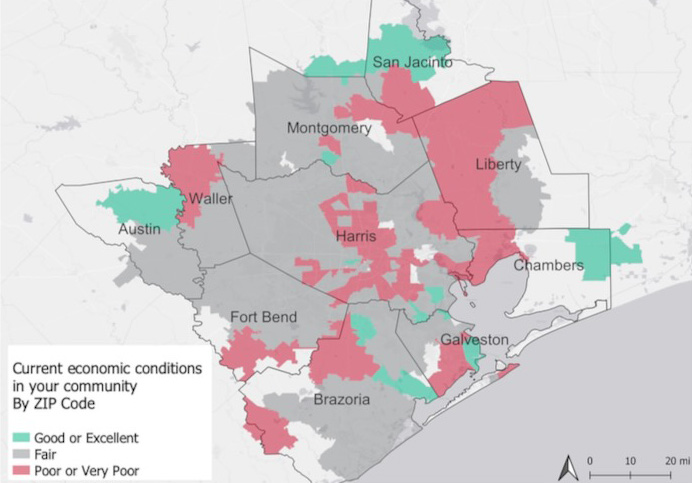

This belt-tightening has contributed to pessimistic views of the local economy, with most residents in the Greater Houston area rating economic conditions as “fair,” “poor” or “very poor.”

Debt is also widespread, as more than 70% of households have some form of debt — the largest, most common being credit cards, car loans and student loans. Type of debt varies by income level, with credit cards accounting for the bulk of debt for households making less than $60,000 annually.

“Lower-income households usually use credit cards more for emergency things like buying food or covering monthly expenses, so their debt builds up, and they have more interest to pay,” said Maria P. Perez Arguelles, lead researcher on the report and research assistant professor at the Hobby School. “This is opposed to higher incomes where you see that they usually have more capacity in their credit cards, but they pay it month by month, so they don’t have to pay for the interest.”

This leads to respondents having a cautious economic outlook. Fewer than one-third expect their income to keep pace with inflation over the next year. Among those certain it won’t, 76% said they’re considering or open to relocating from Houston.

Other key findings include:

- 30% of city of Houston residents rated their community’s economic conditions as “poor” or “very poor” compared to only 17.6% in surrounding areas.

- Debt patterns vary by race and ethnicity, as Black respondents reported student loans as their largest debt; white, non-Hispanic respondents reported higher balances in car loans and credit cards; Asian respondents reported high levels of both credit card and student loan debt; and Hispanic respondents reported high levels of credit card and car loan debt.

- Savings gaps are also stark: white and Asian households are nearly twice as likely as Black and Hispanic households to report having savings or investment portfolios.

These disparities raise concerns about long-term financial security and the ability to weather economic downturns, Perez Arguelles said.

“Those that have savings have a more positive outlook on their financial future,” she said. “Having that savings capacity definitely gives households some confidence about the future.”

The full report is available on the Hobby School website. The survey was conducted Aug. 11-Sept. 4. Previous reports in the series on the job market and climate change are on the Hobby School website.